Recent weeks have seen significant turbulence in the financial markets, with major stock indices experiencing sharp declines. Events like the Dow Jones Industrial Average’s third-largest one-day point drop can understandably cause concern for anyone watching their investments. However, it’s important to remember that market ups and downs, while unsettling, are a normal part of the investment journey, especially over the long term.

Navigating these periods successfully often comes down to perspective and discipline. This post aims to provide context on recent market events and highlight why having a sound financial plan and potentially working with a trusted advisor is crucial during volatile times.

Table of Contents

What’s Been Driving the Markets?

The market volatility in early April 2025 has been fueled by new developments in international trade policy, specifically the announcement and implementation of new, broad-based U.S. tariffs.

Economic Data: Inflation data (CPI & PPI) showed some easing prior to the tariffs but remained above the Fed’s target. Concerns arose that tariffs could push prices higher. The March jobs report showed solid gains but also included downward revisions for prior months.

Tariff Impact: The tariffs, perceived as more aggressive than anticipated, led to a significant market sell-off. The Dow plunged over 2,200 points on April 4th, its third-largest point drop ever, and major indices saw their worst two-day performance since March 2020. The tech sector was hit hard, and even companies with limited direct tariff exposure felt the impact.

Global Response: Key trading partners like China and the EU quickly announced retaliatory tariffs, escalating fears of a global trade war that could disrupt supply chains and slow economic growth. The average U.S. tariff rate reached levels not seen in over a century.

Fed’s Position: Amid this, the Federal Reserve held interest rates steady at 4.25%-4.50% in its March meeting. Acknowledging increased economic uncertainty, the Fed lowered its 2025 GDP growth forecast and raised its core inflation projection, partly reflecting tariff impacts. This cautious stance highlights the complex economic environment.

Keeping Perspective in Turbulent Times

It’s natural to feel apprehensive when markets swing wildly. But history and behavioral finance offer valuable lessons for navigating these periods.

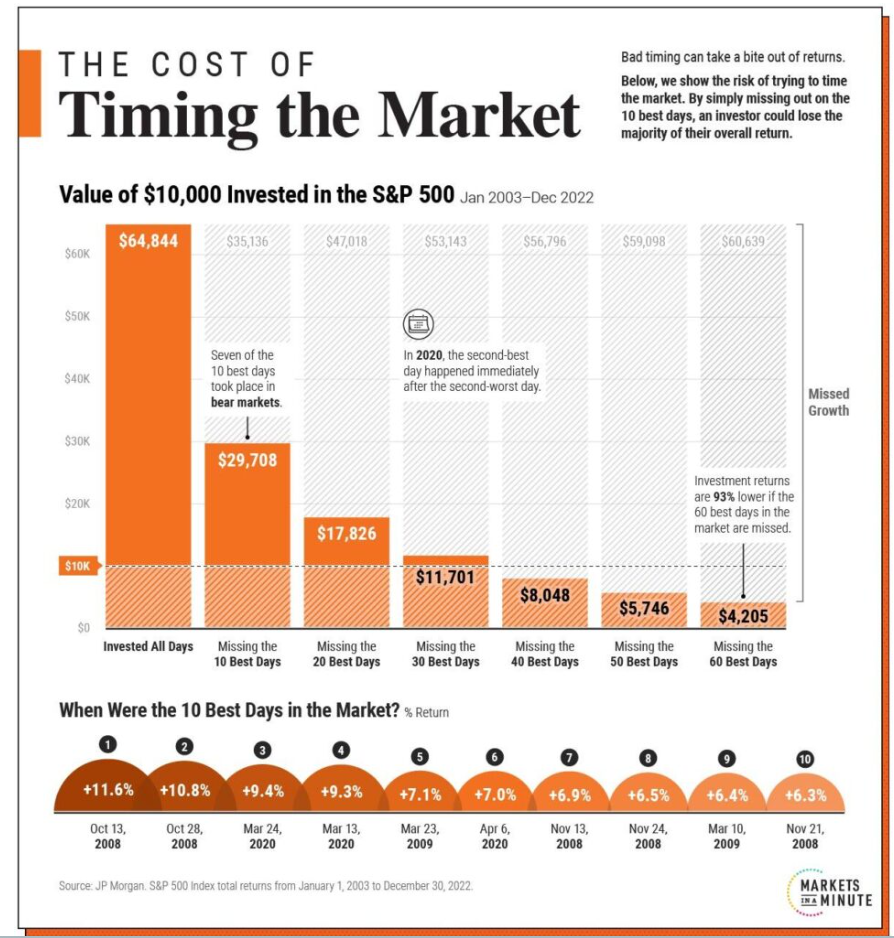

The Futility of Market Timing: Trying to sell before drops and buy before rebounds consistently is nearly impossible. As the graphic below powerfully illustrates, some of the market’s best recovery days happen very close to the worst days. Missing just a handful of these key upswings can devastate long-term returns. Staying invested, especially during turbulence, is often an active strategy grounded in data, requiring significant discipline.

Volatility is Normal: Market fluctuations, including sharp downturns, are not unusual. Markets have weathered numerous crises throughout history and demonstrated long-term resilience.

The Long View: Despite short-term dips, equity markets have historically trended upward over the long haul. Focusing on long-term goals helps investors look past immediate turbulence.

Mind Over Market (Behavioral Finance): Our emotions can lead to costly mistakes. Biases like loss aversion (losses feeling worse than gains), herding (following the crowd), and recency bias (overemphasizing recent events) can prompt panic selling during downturns. This often leads to a “Behavior Gap,” where investors underperform the market due to emotional decisions.

The High Cost of Missing the Best Days

(Source: JP Morgan, S&P 500 Index total returns from January 1, 2003, to December 30, 2022, as shown in the provided graphic)

Bad timing can take a significant bite out of returns. The graphic shows the dramatic risk of trying to time the market based on a hypothetical $10,000 investment in the S&P 500 Index from January 2003 to December 2022. By simply missing out on the 10 best trading days during that nearly 20-year period, an investor could have lost the majority of their overall potential return. Missing more days leads to even steeper declines, potentially wiping out gains entirely.

Crucially, the graphic highlights that seven of the ten best days in this period occurred during bear markets. Furthermore, in 2020, the second-best day happened immediately after the second-worst day. This underscores how difficult and perilous it is to jump in and out of the market – the best gains often occur when sentiment is lowest and volatility is highest.

A Financial Plan: Your Anchor in the Storm

This is precisely when a well-thought-out financial plan proves its worth. A good plan acts as an anchor, providing a framework for decision-making based on long-term objectives rather than short-term noise or attempts at market timing.

- Built for Bumps: A robust financial plan is created with the understanding that markets fluctuate. It anticipates periods of volatility and potential downturns, factoring them into long-term projections and strategies designed to reach specific financial goals.

- Diversification’s Role: Spreading investments across different asset classes (stocks, bonds, etc.) and within those classes (different sectors, regions, company sizes) is crucial. It helps cushion the impact when specific areas are hit hard, like during the recent tariff turmoil. Diversification aims to smooth the ride, though it doesn’t eliminate risk entirely.

- Time Horizon Matters: How soon you need the money dictates your strategy. Long-term goals (like retirement decades away) generally allow for more stock exposure, as there’s time to recover from dips. Short-term goals require more conservative investments to preserve capital. A financial plan aligns investments with specific time horizons.

- The Discipline to Stay Invested: As demonstrated by the cost of missing the best days, remaining invested allows compounding (earning returns on returns) to work effectively. Strategies like Dollar-Cost Averaging (DCA)—investing a fixed amount regularly—reinforce discipline. DCA helps reduce timing risk, potentially lowers your average cost per share, and turns downturns into opportunities to buy more shares at lower prices. It’s a powerful tool, both financially and behaviorally.

Navigating complex markets and sticking to a plan—especially when faced with data like the cost of missing key recovery days—can be challenging alone. This is where working with a qualified financial advisor can make a significant difference.

- Objective Guidance: An advisor provides objective advice, helping you create and adhere to a plan aligned with your goals, risk tolerance, and time horizon. They act as a crucial buffer against emotional decision-making during volatile periods.

- Behavioral Coaching: Advisors understand the psychological pitfalls of investing (like panic selling prompted by fear) and can provide coaching to help investors stay disciplined and focused on the long term, reinforcing the importance of staying invested through turbulent times. They help bridge the “Behavior Gap” by encouraging rational decisions when emotions run high.

- Expertise and Planning: Advisors bring expertise in financial planning, investment management, and often tax strategies. They help build diversified portfolios and ensure the plan adapts to changing life circumstances and market conditions.

- Fiduciary Standard: Many advisors operate under a fiduciary standard. This means they are legally obligated to act in your best interest, providing recommendations free from conflicts of interest, which builds crucial trust.

Looking Ahead with Confidence

While the recent tariff-driven volatility is a stark reminder of market unpredictability, the principles of sound investing—highlighted by the risks of market timing shown above—remain unchanged. Confidence comes not from predicting the future, but from having a well-reasoned plan and the discipline to stick with it through various conditions.

Focus on what you can control: creating a plan, diversifying appropriately, managing costs, and maintaining discipline. Market downturns are historically temporary, but missing the sharp recoveries that often follow can permanently impair your long-term goals. Adhering to a long-term strategy, potentially with the guidance of an advisor, positions you to navigate uncertainty and benefit from potential future growth.

The Power of a Low-Cost, Diversified Portfolio

While having a financial plan and staying disciplined are critical, what you invest in also matters. A well-diversified, low-cost portfolio is a foundational element in navigating volatile markets and achieving long-term success.

Diversification Reduces Volatility

Diversification—owning a mix of asset classes like U.S. and international stocks, bonds, and real estate—can reduce overall portfolio volatility and cushion the impact of sharp downturns in any one market. Historical data shows that a diversified portfolio significantly reduces drawdowns compared to a 100% stock allocation.

Consider the following from Vanguard’s 2023 Index Chart:

| Portfolio Type | Annualized Return (2003–2022) | Worst Year | Standard Deviation |

|---|---|---|---|

| 100% U.S. Stocks | 9.80% | -37.0% (2008) | 18.3% |

| 60% Stocks / 40% Bonds | 7.60% | -20.1% (2008) | 11.1% |

| 40% Stocks / 60% Bonds | 6.50% | -13.1% (2008) | 8.3% |

Source: Vanguard, 2023 Index Chart, based on U.S. stocks (S&P 500), U.S. bonds (Bloomberg U.S. Aggregate Bond Index), and portfolio blends.

This data illustrates how a 60/40 portfolio reduced the 2008 drawdown by nearly half compared to an all-stock portfolio, while still achieving solid long-term returns. For investors with lower risk tolerance or shorter time horizons, increasing bond allocations can provide further downside protection.

Low-Cost Index Funds Improve Net Returns

Costs matter—especially in volatile markets. Every dollar paid in fees is one less dollar compounding for you. According to a 2022 Morningstar report:

“Low-cost funds outperformed high-cost funds in every asset class over a 10-year period, with fees being one of the strongest predictors of future performance.”

— Morningstar Research: “Mind the Gap 2022”

The report found that the cheapest quintile of funds had a 10-year success rate of 35.6%, compared to just 14.3% for the most expensive quintile.

By combining low-cost index funds with smart diversification, investors can lower risk, reduce fees, and improve the odds of staying invested—especially during downturns.

Simplicity That Works

A globally diversified portfolio of index funds—covering U.S. large-cap, mid-cap, small-cap stocks, international stocks, and bonds—offers broad exposure at low cost. It’s a strategy used by many institutional investors and increasingly embraced by individual investors and fiduciary advisors.

This approach aligns with the evidence: over time, diversification and low fees consistently outperform attempts at market timing or picking “winning” funds.

Ready to Build Your Plan?

If recent market events have you feeling uncertain about your financial future—or if you realize you lack a clear, cost-efficient strategy designed to weather storms and avoid costly mistakes—now might be the time to take action.

Building a plan that includes a low-cost, globally diversified portfolio can reduce volatility, improve long-term outcomes, and give you the confidence to stay on track, even during turbulent times. When combined with the discipline of staying invested and a financial plan tailored to your goals, this approach becomes a powerful way to navigate uncertainty.

Consider working with a fee-only fiduciary advisor who can help you build a plan, align your investments with your time horizon and risk tolerance, and avoid the pitfalls of emotional decision-making. Confidence doesn’t come from predicting markets—it comes from being prepared for whatever the market throws your way. Contact us today to get started.

Disclaimer:

The information provided in this blog post is for educational and informational purposes only and should not be construed as personalized investment advice or a recommendation to buy or sell any particular security or investment strategy. All opinions expressed are those of the author and are based on current market conditions as of the time of publication, which are subject to change without notice.

Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Market data and performance figures cited are believed to be accurate but have not been independently verified. Examples provided are hypothetical and for illustrative purposes only. They do not represent the results of any specific investment and are not guarantees of future performance.

Any reference to the benefits of working with a financial advisor is general in nature and should not be interpreted as a guarantee of specific outcomes. Please consult a qualified financial professional before making any financial decisions.